Bridal Bliss Insights

Your go-to blog for all things weddings, trends, and bridal elegance.

Marketplace Liquidity Models: The Secret Sauce behind Successful Platforms

Unlock the secrets to thriving platforms! Explore marketplace liquidity models that drive success and boost user engagement like never before!

Understanding Marketplace Liquidity: Key Models and Strategies

Understanding marketplace liquidity is crucial for both buyers and sellers in any trading environment. At its core, liquidity refers to how easily assets can be bought or sold in the market without causing significant price fluctuations. A liquid market typically features a high volume of transactions and a wide array of participants, leading to more favorable conditions for executing trades. Businesses can leverage different liquidity models—such as central limit order books or automated market makers (AMMs)—to enhance their marketplace efficiency, ensuring that participants can transact seamlessly.

When developing strategies to improve marketplace liquidity, it's essential to consider several factors. Market depth and spread play important roles; deeper markets often exhibit tighter spreads, which can lead to more active trading. Furthermore, employing techniques like incentivizing liquidity providers or implementing dynamic pricing models can enhance overall liquidity. Ultimately, prioritizing liquidity in marketplace design not only improves user experience but also fosters a more stable trading environment, making it an essential focus for any marketplace operator.

Counter-Strike is a popular first-person shooter game series that emphasizes teamwork and strategy. Players engage in various game modes, often focusing on completing objectives such as bomb defusal or hostage rescue. For gamers looking to enhance their experience, be sure to check out the daddyskins promo code for exciting in-game rewards. The competitive scene of Counter-Strike has also given rise to professional tournaments, attracting players and fans from around the globe.

How to Optimize Your Platform's Liquidity for Maximum Success

To achieve maximum success, it's essential to optimize your platform's liquidity, which refers to the ease with which assets can be bought or sold without affecting their price. Here are several strategies to effectively improve liquidity:

- Increase trading volumes: Encourage more traders and investors to participate on your platform by offering incentives, such as reduced fees or rewards for frequent trading.

- Implement a robust market-making strategy: Utilize algorithms or third-party services to provide consistent buy and sell orders, narrowing the bid-ask spread and enhancing liquidity.

Moreover, ensuring a user-friendly interface can significantly impact liquidity. A seamless experience attracts more users, leading to higher trading activity. To further drive liquidity, consider:

- Expanding asset offerings: Introduce a diverse range of cryptocurrencies or securities to cater to various trader interests.

- Fostering community engagement: Build a strong community around your platform through social media and forums to create buzz and attract new users.

What Makes a Marketplace Successful? The Role of Liquidity Models

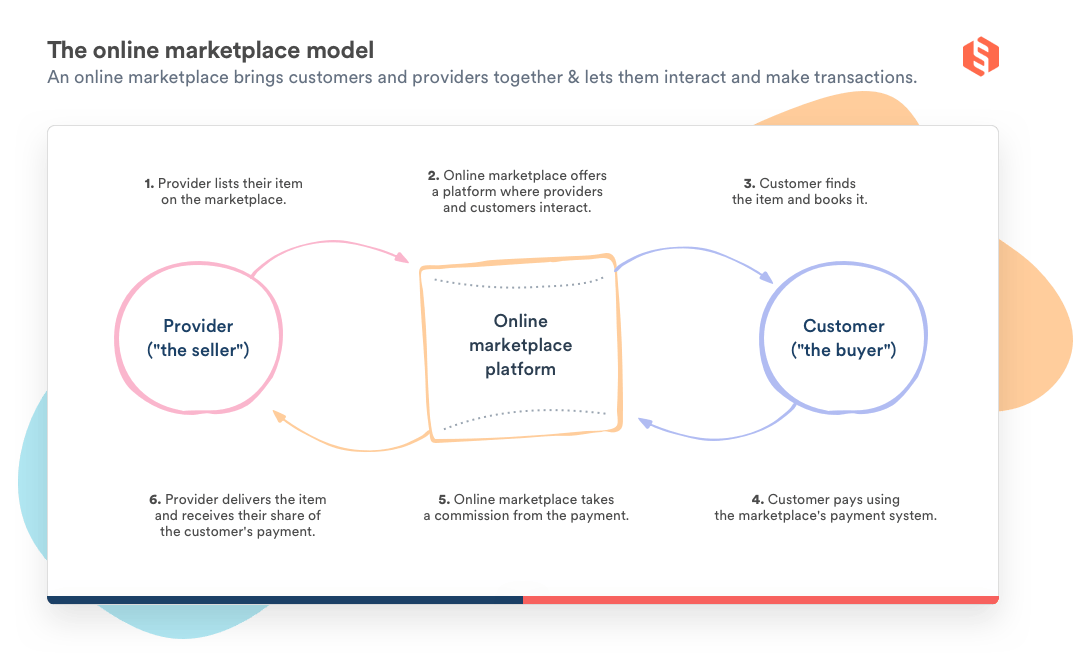

In the ever-evolving landscape of online marketplaces, liquidity models play a pivotal role in determining success. A successful marketplace is characterized by a high volume of transactions, where buyers and sellers can interact seamlessly. This liquidity is essential as it not only enhances user experience but also boosts trust among participants. By implementing robust liquidity models, such as order matching or automated market makers, marketplaces can ensure that there are always enough buyers and sellers to facilitate transactions, leading to a dynamic and engaging platform.

Furthermore, liquidity models contribute to price stability and reduce the risks associated with price volatility. When a marketplace is highly liquid, it allows users to enter and exit positions more easily, creating a sense of security and encouraging greater participation. As platforms implement innovative solutions to enhance liquidity, they not only attract more users but also cultivate an ecosystem where various stakeholders feel empowered. Ultimately, the synergy between a thriving community and effective liquidity models is what fosters long-term sustainability and success for any marketplace.